Smart Accounts

$0 fees. Smart business accounts with BSB and account numbers to receive income and manage spending. Set automation rules based on live tax—then forget the rest.

Every time your bookkeeper reconciles on Xero, your taxes and super stay live, accurate, and organised — automatically.

Easy online onboarding · Subscription tax-deductible · Cancel anytime

By continuing, you agree to receive WorkUp marketing communications. You may unsubscribe any time. See Privacy Policy

Trusted by businesses & accountants using

A smarter way to manage your business finances.

$0 fees. Smart business accounts with BSB and account numbers to receive income and manage spending. Set automation rules based on live tax—then forget the rest.

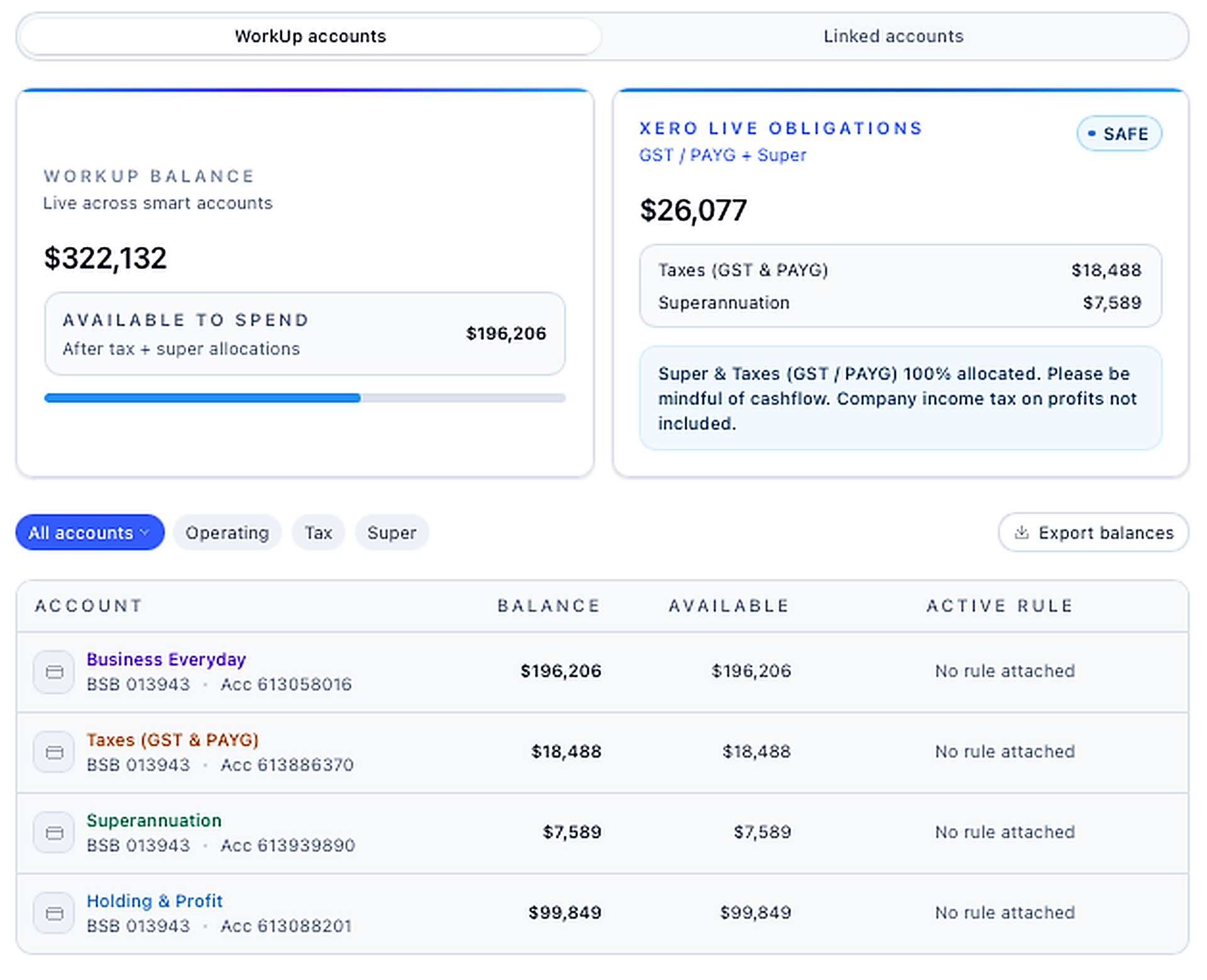

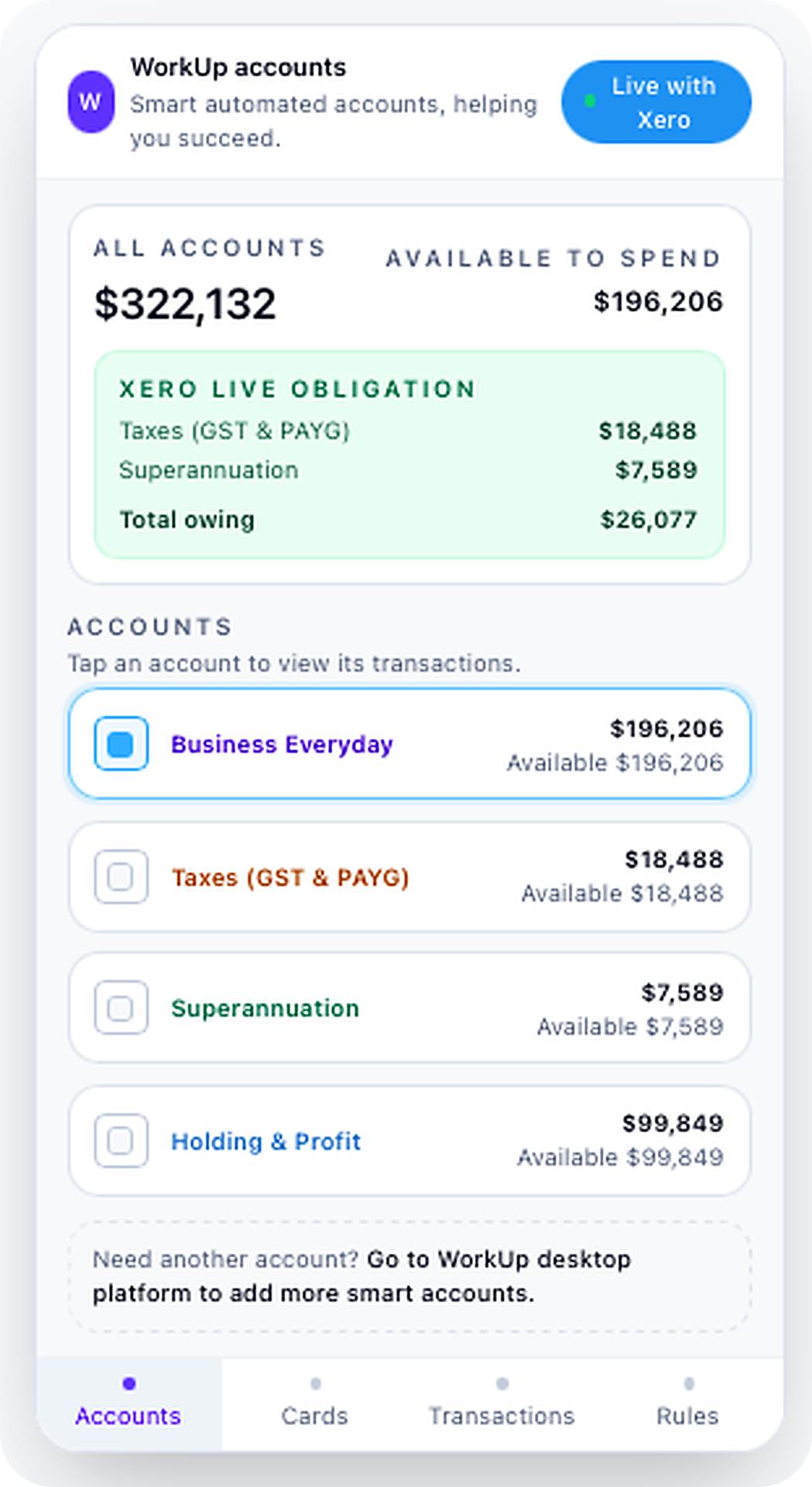

WorkUp's Live Integrated Tax Engine reads and calculates your Xero balance sheet and converts it into live, real-time tax and super figures.

For the first time, you can see live tax and super directly from Xero - so you always know exactly where you stand.

Create automation rules on smart business bank accounts, so your taxes are organised - automatically.

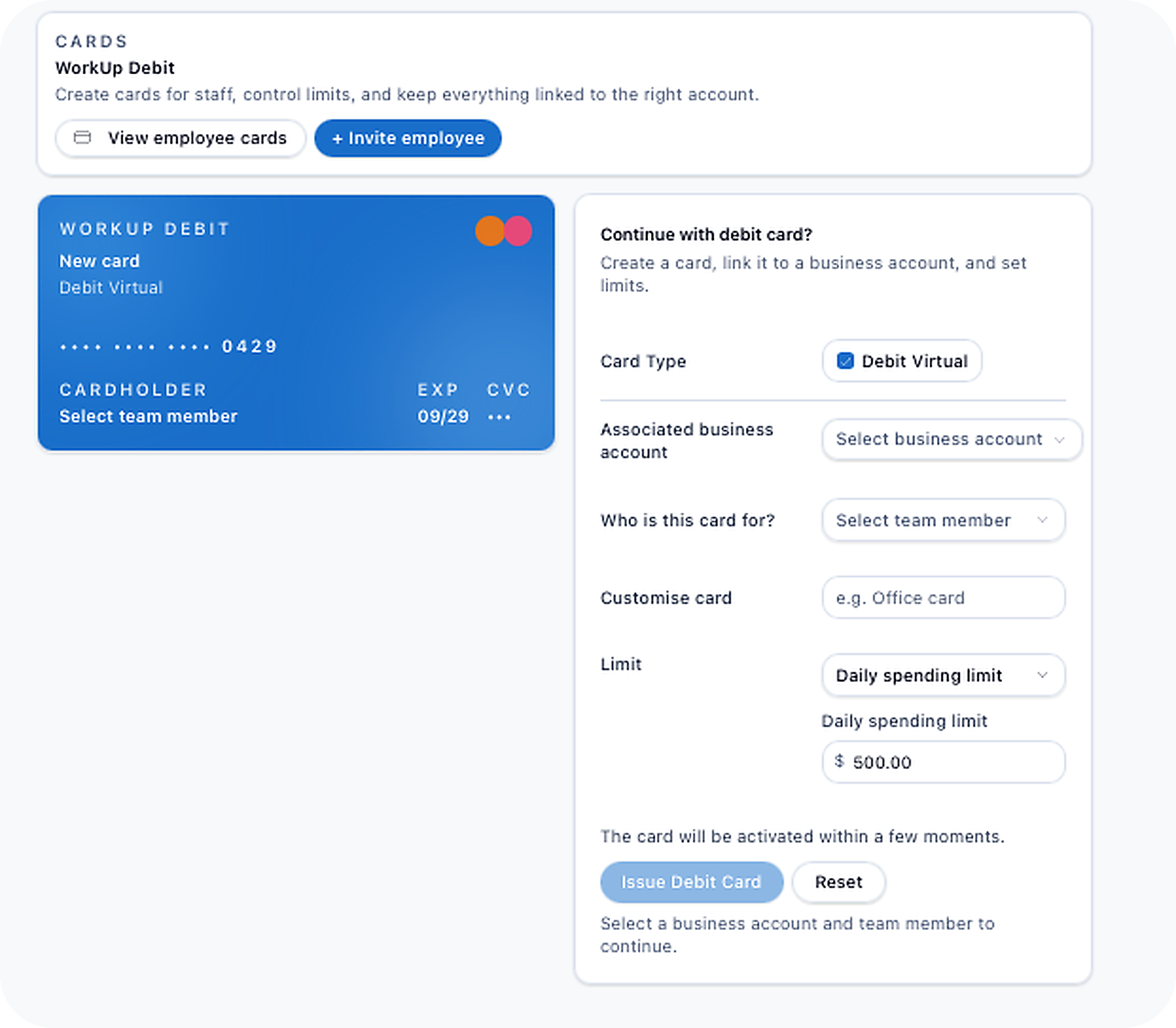

Create cards with budgets to control bad spending behaviours for your whole team.

WorkUp integrates with Xero, retrieving live data from the balance sheet to calculate taxes and super, so you can set auto rules and forget all about it.

Businesses don't fail because they can't pay tax — they fail because they don't know what's actually theirs.

It's easy to accidentally spend tax or super. With WorkUp, you get real-time clarity on what you can safely spend.

Books updated. Taxes stay live. Cash is clear. Make decisions with fresh numbers, not end‑of‑quarter guesses.

Easy online onboarding · Subscription tax-deductible · Cancel anytime

By continuing, you agree to receive WorkUp marketing communications. You may unsubscribe any time. See Privacy Policy

No end‑of‑quarter scramble. See positions in real time.

GST

$56,569

PAYGW

$22,832

Superannuation

$8,546

Xero

Reconciled

Taxes

Automatically organised

Your Business Finances

Organised for success

Banking automation that keeps your taxes and employee super organised for success.

WorkUp makes sure all your taxes and employee super are known and organised, never before has a bank provided this level of integration, calculation & automation — built for you to succeed through all the challenges your business throws at you.

Process payments your way with Australia's most popular payment methods

Add more accounts and cards as you grow.

Easy online onboarding · Subscription tax-deductible · Cancel anytime

What's included

Scale as you grow

Extra Bank Accounts

Add more than the included accounts.

$15 each / month

Extra Cards with Budgets

Add more team cards with spend controls.

$15 each / month

Partner: Airwallex Embedded Finance APIs.

Airwallex Pty Ltd holds an Australian Financial Services Licence, overseen by ASIC.

Airwallex is regulated by AUSTRAC; reporting entities must run AML/CTF programs (KYC, monitoring, reporting).

Your wallet balance is covered by bank guarantees from APRA‑regulated banks, held on trust by independent trustee GLAS.

Know where you stand, financially.

"We finally stopped guessing. Taxes and cash are live, every day."

"Setup took minutes. The daily books changed how we operate."

"It feels like a finance team that never sleeps."

Yes. A tax-deductible monthly cost that keeps GST, PAYG and super live, accurate and under control, and stops $20k–$200k problems before they exist.

Real-time GST, PAYGW and Super positions.

Yes. For now, we are building WorkUp for localised businesses using Xero, that want to organise live taxes automatically and eliminate financial mismanagement.

Connect Xero to WorkUp and route your income into your new Everyday account so you can keep your GST, PAYG and super live. Then set simple automation rules so your tax and super stay accurate and organised automatically.

Accountants use Xero as the source of truth—and you should always use an accountant. WorkUp connects to Xero, retrieves your live data, and automates the important stuff, making your business more simple, clear, and accurate—so you've got the best shot at building a successful business.